A customer goes through multiple steps to order something from your website. Adding an item to cart doesn’t really mean anything unless they checkout, which makes the checkout moment very critical.

But, if there is friction in the payment, conversion might drop. What makes it more important is the fact that in 2023, customers aged below 55 used cash for only 12% of payments.

Cash is losing big time and the gap is going to get wider.

According to SSLCOMMERZ, 40% of customers decided to skip transactions when the payment system is lengthy or difficult.

Plus, you are operating in a market that’s going to be $8 trillion in size by 2026. And this entire market is moving towards a cashless economy. To take advantage of this growth, you need to start focusing on payment ecosystems and which e-commerce platforms provide the best solution.

That’s why comparing Shopify vs. Magento payment gateways should be strategic. The right ecommerce payment integration and magento payment methods can influence

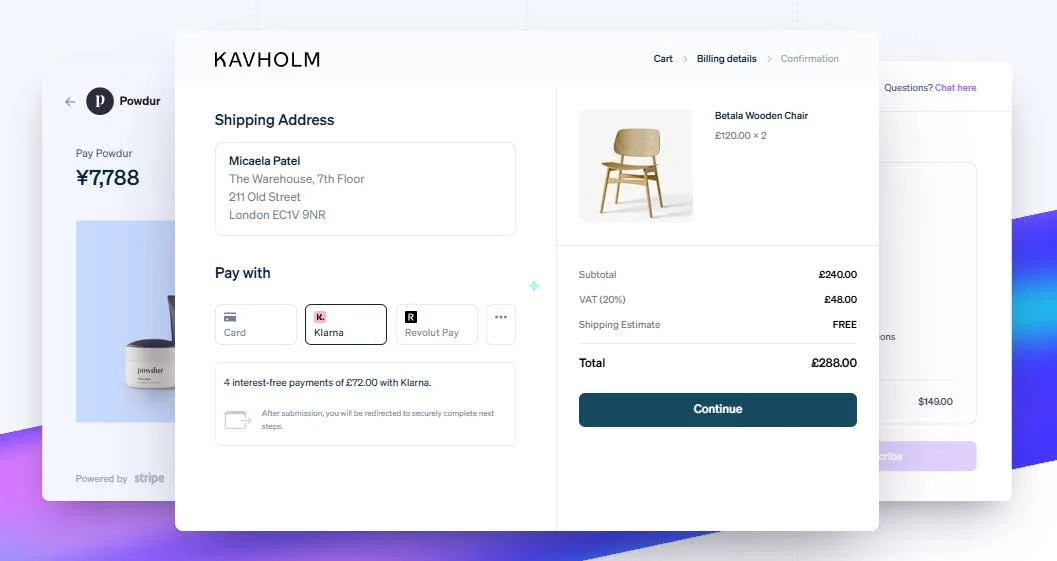

Shopify Payment Gateway Options

Shopify makes payment integration very user-friendly. According to Shopify itself, you can choose from over 100 charge-processing providers worldwide.

What Does Shopify Offer?

- Native option – Shopify Payments

Built-in, no extra monthly gateway fee, optimized checkout.

- Third-party gateways

PayPal, Stripe, Authorize.Net and others. Just to be clear, Shopify may add a 2% fee if you don’t use Shopify Payments.

- Multi-currency and global support

Shopify supports merchants in many countries, helping global ecommerce reach.

- Ease of setup

Turn on a toggle, fill banking details, you’re ready.

What Are The Pros and Cons of Shopify Integration?

Before making a decision, it’s better to know the good and the bad sides of using Shopify -

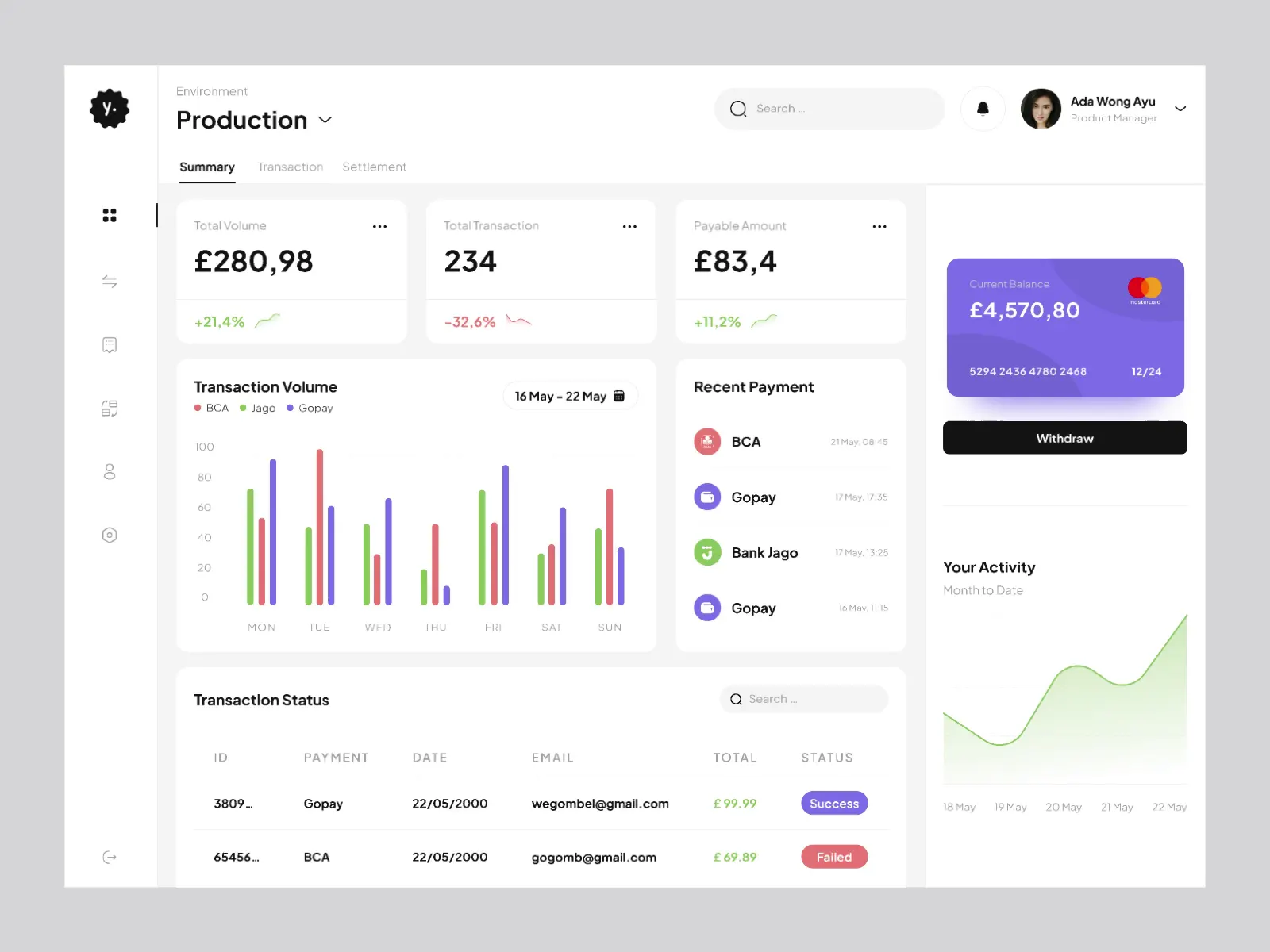

Magento Payment Methods

When discussing ecommerce payment integration, you can’t miss Magento. It caters to more complex operations,and so its payment gateway integration emphasizes flexibility. Magento payment methods handle around $155 billion transactions every year.

What Does Magento Offer?

- Wide choice of payment methods

Credit cards, wallets, buy-now-pay-later, region-specific providers.

- Fully customizable checkout & payment logic

You can build custom flows for fraud control, subscription billing, and split payments.

- Enterprise-grade configurations:

Support for multiple stores, multiple currencies, multi-region checkouts.

- Third-party modules and extensions:

Many marketplace extensions add specific gateway support.

What Are The Pros and Cons of Magento Payment Methods?

And we are back with another table -

Shopify vs. Magento Payment Gateways Comparison

Looking at this ecommerce payment integration tells a different story from a side-by-side comparison. So, here’s a quick comparison of key aspects of Shopify vs. Magento payment gateways -

From a global geolocation perspective, if you're selling in multiple countries with varied checkout norms, Magento payment methods might give you more flexibility. But if you want to launch fast, keep operations lean, Shopify integration of payment gateways is very strong.

What Should Global Ecommerce Consider?

When comparing Shopify vs. Magento payment gateways for your international store, keep a few things in mind -

- Some countries prefer local wallets; others trust global players like PayPal.

- Make sure the gateway supports your currency and settles funds in a way suited to your location.

- Hosting versus managed gateway models have different responsibilities.

- Shopify adds extra fees for using external gateways.

- You want a smooth setup, consistent data with your orders, and minimal friction.

- As you grow, your gateway should support higher volume, international traffic, and complex logic.

Some Recommendations for Ecommerce Payment Integration

Following these advice when selecting between Shopify vs. Magento payment gateways will increase the likelihood of you making the right choice -

- If your store is small-to-mid size and your checklist includes ease, speed, cost-predictability, lean toward Shopify and its ready payment integrations.

- If you’re enterprise level, sell globally, or need advanced payment logic like subscriptions, split pay, custom checkout, Magento likely gives more room to grow.

- Whatever platform, test your checkout experience. Reduce friction, monitor abandonment rates, and ensure payment method diversity aligns with your audience.

- Keep an eye on gateway fees + alternative cost layers, conversion fees, settlement delays, external gateway fees, especially when scaling globally.

- Use analytics to monitor payment conversion rates, regional drop-off, and cost per transaction.

Want to learn more? Check out our blog!

FAQs

Q1. What is the difference between Shopify vs. Magento payment gateways?

The difference lies in setup ease, customization and cost. Shopify offers turnkey gateway integrations with simplicity, but Magento provides deeper flexibility and requires more investment and technical expertise.

Q2. What is ecommerce payment integration?

It is the process of connecting your online store with a payment gateway so that you can securely accept payments, manage checkout logic, support multi-currency/multi-country, and track transactions.

Q3. Can I use the same payment gateway on both Shopify and Magento?

Yes, many gateways for instance, PayPal, Stripe, Adyen, etc. support both platforms. The difference is how the integration is configured, managed and how deeply you can customize payment flows.

Q4. Are Magento payment methods more flexible than Shopify’s?

Yes, Magento allows full control over payment logic, custom checkout flows, and multi-store/multi-currency setups, making it more flexible.

Q5. What global factors should I consider when choosing payment gateways?

Consider currency support, local payment methods, regional regulation (PCI compliance), fees for cross-border transactions, and how the gateway integrates with your platform’s checkout experience.

.jpg)

.png)

.jpg)